Understanding Technical Analysis in Oil Trading

Technical analysis is vital for successful trading. In this piece, we will introduce the idea of technical analysis and discuss its role in determining trading choices. With insightful comparisons to the world of gold trading, our main focus is on exploring the use of technical analysis in the complex field of oil trading.

We’ll emphasize how technical analysis enables traders to systematically assess market data, identify patterns, determine support and resistance levels, and make educated decisions. Join us as we explore the complexities of technical analysis and examine how it has changed commodities trading. We’ll draw insightful conclusions from the oil and gold markets.

I. Technical Analysis Fundamentals

Technical analysis is an organized way of evaluating financial markets that mainly focuses on predicting future price movements by examining historical price data and trading activity. Its main goal is to find patterns, trends, and future market reversals based on previous price behavior.

Technical analysis focuses on price charts and indicators, compared to fundamental study, which explores a company’s financial health and macroeconomic issues. Although they are different from one another, these two approaches both provide information to traders and investors.

Technical analysis offers exact entry and exit points. In contrast, fundamental analysis provides context, constituting a complete selection for educated decision-making in the dynamic world of trading.

II. Common Technical Analysis Tools: Oil and Gold Markets

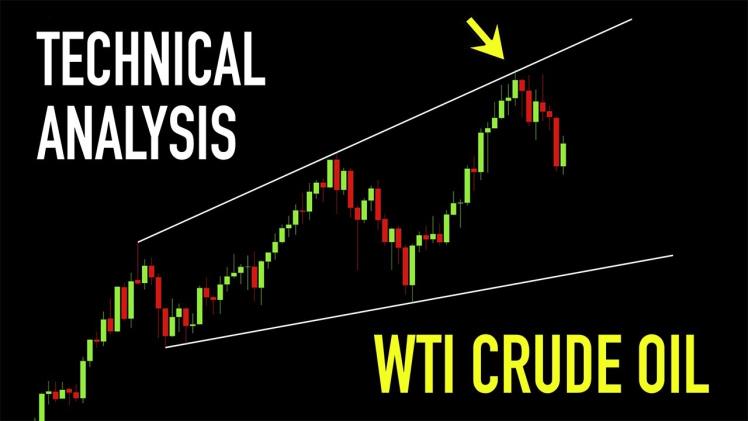

Trendlines, moving averages, and candlestick patterns are essential technical analysis techniques that are always useful in trading gold and oil. Trendlines show price movement, which helps traders spot trends.

Price data is smoothed by moving averages, which helps confirm trends. Candlestick patterns reveal the mood of the market. These adaptable tools go across asset classes and are invaluable for making profitable choices in the oil price forecast and gold markets.

III. Applying Technical Analysis to Oil Trading

Technical analysis is important in the oil industry due to its highly sensitive nature to supply-demand dynamics and geopolitical factors. When oil prices fluctuate significantly, trendlines can be used to spot trend reversals.

Moving averages improve trend analysis and support decision-making by averaging out price data. Candlestick patterns help traders determine how the market behaves and how geopolitical events will affect oil prices. Together, these sources enable traders to make knowledgeable assumptions and choices in the complex realm of oil trading.

IV. Correlation between Oil and Gold Technical Analysis

Analyzing changes in the price of gold can easily be done using the same technical analysis concepts used in oil trading. The sensitivity to changes in the world economy is one of the characteristics that both markets have in common. Even when the commodities vary, the technical indicators—trendlines, moving averages, and candlestick patterns—remain the same and provide details on both markets.

Cross-analyzing various assets gives traders a broader perspective. It reveals important distinctions and linkages that expand their toolkit for making decisions in the complex world of commodities trading.

V. Integrating Fundamental Factors: Oil and Gold Trading

The interaction of fundamental and technical analysis is critical in both oil and gold trading. Learn more about Gold trading tips at Vstar.com. Oil traders closely follow OPEC decisions, supply disruptions, and economic data to supplement technical insights. Similarly, interest rates and inflation are taken into account by gold traders as guiding principles.

By bridging the gap between market emotions and underlying economic fundamentals in these separate yet connected commodities markets, the seamless integration of these components improves traders’ capacity to make educated decisions.

VI. Challenges and Limitations of Technical Analysis

It’s critical to understand the limitations of relying just on technical analysis. Technical analysis could prove imperfect because unanticipated events, including geopolitical crises or unforeseen economic shocks, can alter anticipated price trends. Previous data might be quickly overshadowed by market emotion.

To effectively manage the volatile financial markets, traders should exercise cautiousness and think about taking a comprehensive approach that combines technical analysis with fundamental insights.

VII. Evolving Markets and Continuous Learning

Technical analysis strategies must evolve as markets evolve. Keeping up with market developments and continuing to learn is imperative. Due to the dynamic nature of financial markets, traders must be flexible in their approach so that they can effectively navigate changing conditions. The ability to adapt to an ever-changing trading market requires traders to embrace lifelong learning.

Conclusion: The Universality of Technical Analysis

This paper emphasizes the versatility of technical analysis across various asset classes. It emphasizes the importance of technical analysis as a useful tool for traders, providing information on price trends, entry and exit points, and market mood.

It also highlights the significance of including technical analysis in more comprehensive trading techniques. Traders can efficiently use its strength while adjusting to the complexity of numerous asset classes by understanding that it’s simply one aspect of a thorough market study.